Hosting investor roundtables at Greentown Labs is like getting a backstage pass to the future of climatetech—where optimism meets reality checks, and everyone’s obsessed with the same question: how do we actually decarbonize the world without going broke?

Climatetech is at a turning point. Greentown’s recent investor roundtables in Boston and Houston painted a clear picture: everyone still believes in the urgent need to decarbonize, but the playbook is changing. Investors are balancing their long-term climate goals with short-term realities—funding is harder to get, policies are shifting, and more than ever startups need to prove they can make money, not just make an impact.

The big takeaway? The mission hasn’t changed, but the rules of the game have. Companies that can deliver both environmental benefits and solid business fundamentals will be the ones that thrive in this new era.

The Funding Winter: A Wake-up Call for Climatetech

The era of easy money is over. Investors emphasized that the days of raising massive rounds for capital-intensive hardware plays without clear revenue paths are fading.

“We’re seeing Series B and C rounds collapse for companies that can’t demonstrate near-term profitability,” noted one Boston-based VC. “The bar has been raised—startups need to show they can survive without endless subsidy lifelines.”

This reset is particularly acute in sectors like direct air capture and green hydrogen, where projects often rely on government incentives. While the Inflation Reduction Act (IRA) has provided a critical tailwind, investors warned that over-dependence on policy support is risky—as demonstrated by shifting tides at the federal level.

Yet, there’s a silver lining: the funding crunch is forcing discipline. Startups that have tightened operations, focused on customer revenue, and pursued capital-efficient models are thriving.

“The best companies aren’t waiting for perfect policy—they’re building businesses that work in today’s market,” said a Houston-based investor.

Policy in Flux: A New Reality

Slashed support at the federal level loomed large in discussions. While the IRA’s tax credits are likely here to stay—many are already locked into projects—investors are bracing for possible shifts in enforcement, permitting, and Department of Energy grant programs.

“If you’re betting your company on a future 45Q expansion or a hydrogen hub grant, you’re playing with fire,” cautioned one corporate venture lead.

However, some sectors may emerge as bipartisan winners. Grid resilience, domestic critical minerals, and nuclear energy were highlighted as areas where policy support could endure.

“No one wants blackouts or to rely on China for materials,” noted an energy-transition fund manager. “These are national security issues now.”

Where Capital Is Flowing: Pragmatic Bets for a Tough Market

Amid the constraints, investors identified several areas attracting disciplined capital:

1. Industrial Decarbonization (Beyond Hype)

While heavy industries like steel and chemicals remain challenging, startups offering measurable efficiency gains—heat recovery systems, AI-driven process optimization, and modular carbon capture—are cutting through the noise.

“The winners are those solving today’s problems, not just future aspirations,” said a materials-tech investor.

Greentown members leading the charge in this critical sector:

Ardent – Delivering next-gen scalable membrane solutions for industrial decarbonization, Ardent is already running three pilot projects across the U.S. and Europe to tackle emissions where it counts.

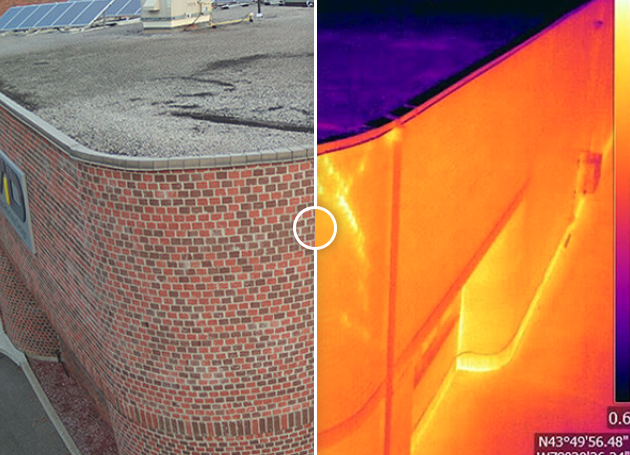

QEA Tech – An AI-powered software platform accelerating the decarbonization of the built environment by making it easier and faster to detect and address energy inefficiencies in large buildings.

2. Grid-edge Innovation

With transmission projects facing decade-long delays, investors are backing distributed solutions:

- Behind-the-meter generation (e.g., on-site renewables paired with storage)

- Advanced conductors to squeeze more capacity from existing lines

“The grid is the bottleneck of the energy transition—but that just means the solutions are invaluable,” remarked a utility-focused fund manager.

Greentown members answering this hot topic include:

REON – Using AI to optimize and automate battery and microgrid systems, REON helps unlock 2–4X greater asset capacity, making distributed renewables significantly more efficient and scalable.

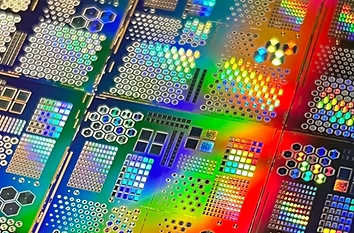

Vertical Horizons – Commercializing next-gen power supply units for AI and high-performance computing, powered by breakthrough vertical gallium nitride (GaN) technology—bringing efficiency and performance to the grid’s edge.

3. Maritime and Heavy Transport

Often overlooked, maritime decarbonization is gaining traction, particularly for regional routes where electric or methanol-powered vessels make economic sense.

“Ferries and short-haul shipping are low-hanging fruit,” noted a transportation specialist. “The economics work even without subsidies.”

Greentown members leading the charge in this critical sector:

Flux Marine – Redefining marine mobility with electric propulsion systems that directly replace traditional combustion engines—delivering cleaner, quieter, and more efficient performance on the water.

ESki – Bringing a sustainable twist to recreation, ESki is revolutionizing the personal watercraft industry with an electric alternative to gas-powered jet skis, merging performance with planetary care.

A Hopeful Undercurrent: The Rise of ‘Climate Pragmatists’

Despite the challenges, the roundtables revealed a growing cohort of “climate pragmatists”—investors backing technologies that marry impact with near-term viability.

“The companies succeeding now aren’t waiting for the world to change,” summarized a veteran cleantech investor. “They’re finding niches where decarbonization pencils out today—and that’s how we’ll scale.”

Investors emphasized that as capital becomes more selective, the startups that survive will be those built not just on visionary technology, but on resilient business models.

For founders, the message is clear: the climate imperative hasn’t changed, but the playbook has. In this new era, profitability isn’t at odds with purpose—it’s the prerequisite for impact.

Join the Conversation

Investors: Join Greentown’s Investor Program to participate in our upcoming roundtables in May and June. Let’s build what’s next, together.

Marita Genebashvili is the Director of Investor Program at Greentown Labs.