Chidalu Onyenso is a dual citizen of Nigeria and the U.S., a newly minted Harvard Business School grad, and on a mission to bring reliable, clean energy to Nigeria’s small and medium businesses.

“I was testing what financing owners of small and medium businesses need in Africa; I talked to so many and did a lot of market research interviews, and it kept coming down to energy,” she says.

Onyenso is the founder of EarthBond, a startup leveraging solar financing to replace businesses’ diesel- and petrol-generator use in “under-grided” areas. Only about half of Nigeria is connected to the electric grid, and even those who have grid access typically get just six to eight hours of power per day, Onyenso explains. Many types of companies can’t operate on such inconsistent energy, and so business owners rely on generators to fill in the gaps.

Eighty-six percent of companies in Nigeria use a generator, and a 2019 International Monetary Fund report put the annual economic cost of inaccessible or unreliable electricity at $29B.

Solar power is more affordable than generator-use, but up-front installation costs are prohibitive to many small and medium businesses (SMBs). That’s the challenge EarthBond is tackling by connecting SMBs reliant on energy—think pharmacists, tailors, agricultural processors, and more—with lease-to-own solar financing.

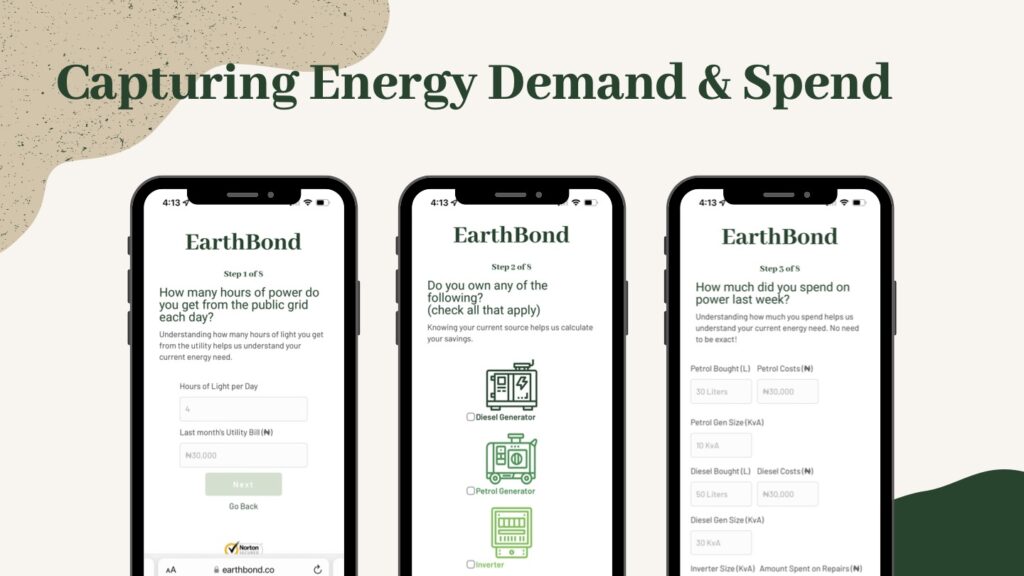

EarthBond analyzes SMBs’ energy needs and financial situations in order to match businesses with the best solar installers and payment plans, while also leveraging carbon offset credits to defray costs.

According to Onyenso, EarthBond customers save about 20 percent month-over-month compared to diesel fuel while leasing, and typically own their installation outright in two to five years. EarthBond receives an origination fee from the capital provider equivalent to five percent of the total amount that a customer qualifies for.

“From an economic development perspective and an equity perspective, this is making it economically viable for Africans to tap into the energy transition,” Onyenso says.

Replacing diesel and petrol generators with solar energy also has significant climate implications: “About 29 million metric tons of CO2-equivalent are emitted by diesel generators in Nigeria every year; if you can transition some of those users away, it’s quite impactful,” Onyenso says.

EarthBond uses group referrals both to build its customer network and to lower default risks. Business owners get a rebate when they refer others, and the groups get further rebates as they continue to pay on time.

The startup incorporated in 2022 and has deployed its initial pilots. It’s growing its pool of financial and solar partners, developing its customer-acquisition model and go-to-market strategy, and preparing to raise its pre-seed funding round.

EarthBond is part of the inaugural cohort of ACCEL—an accelerator from Greentown and Browning the Green Space (BGS) designed to support BIPOC-led startups by offering access to funding, networking connections, resources, and opportunities that structural inequities put out of reach. The program combines acceleration with a curated curriculum, incubation through Greentown membership, and extensive mentorship from Greentown and BGS’s networks of industry experts.

Onyenso says the programming and mentorship has been valuable and that she’s found community among the cohort’s fellow founders.

“ACCEL has been amazing,” she says. “I’ve really enjoyed the membership and programming. I think it’s fantastic—if I met another Black or Brown founder focused on climatetech, I’d tell them to apply to this program, 100 percent.”